Insurance inventory, made easy

Your central dashboard for managing your entire home inventory. Create new spaces, access your vault, and track recent activity all from one intuitive interface. Get started with AI-powered inventory collection in seconds.

Create dedicated spaces for each room in your home. Upload videos, images, and receipts, and let our AI automatically process and catalog your inventory. Smart recognition identifies items, estimates values, and organizes everything for instant access.

Review, edit, and manage your AI-processed inventory with precision. View detailed item information, update values, add custom notes, and ensure every possession is accurately documented. Your complete inventory at your fingertips.

Your secure repository for finalized inventory data. Share access with family members, export comprehensive CSV files, and generate detailed PDF reports with analytics. Everything you need for insurance claims, estate planning, or peace of mind.

Intelligent copilot providing instant access to regulatory knowledge, claims precedents, and underwriting guidance. Real-time compliance intelligence and natural language queries for insurance professionals.

Enterprise-grade document repository with smart policy management, litigation-ready evidence storage, and compliance archival. Blockchain-verified timestamps ensure document integrity and legal admissibility.

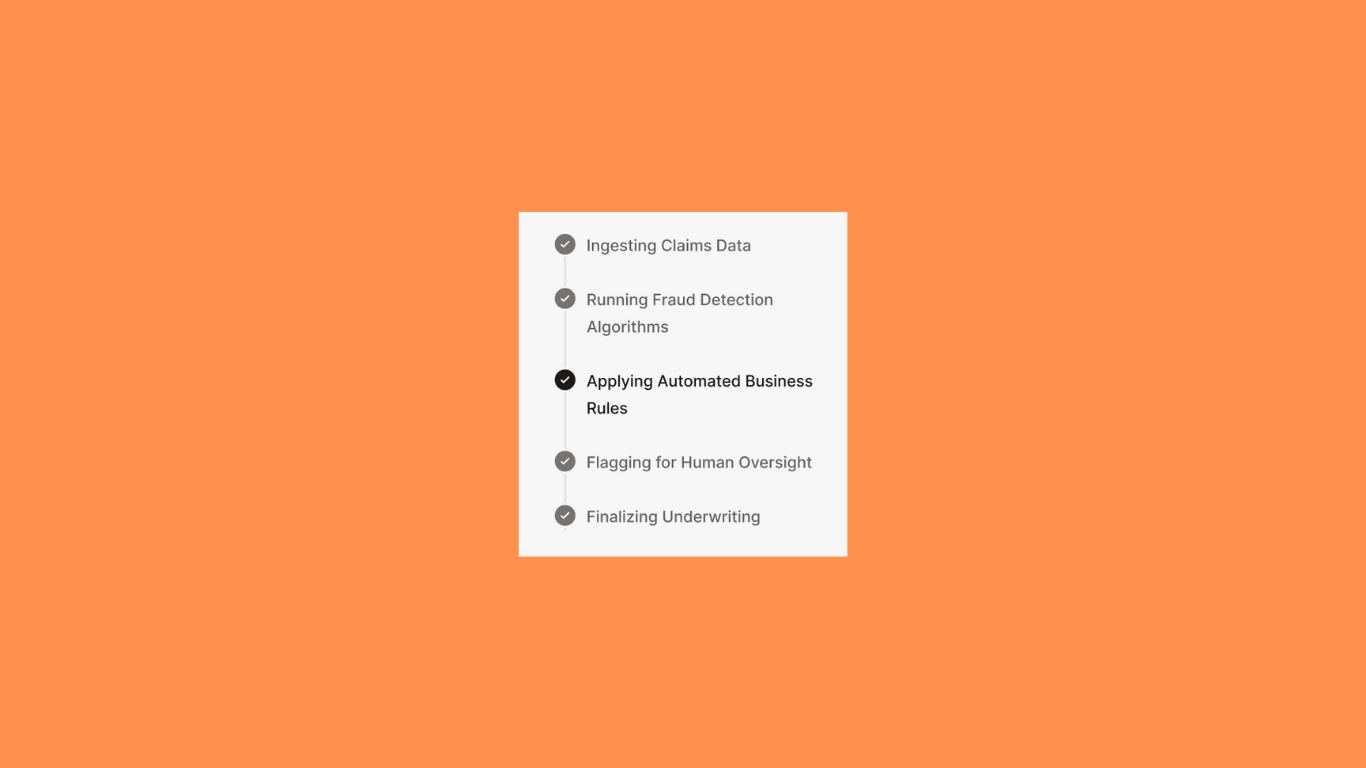

Automated insurance operations across claims, underwriting, and fraud detection. Intelligent processing with configurable business rules and human oversight for complex decisions.

Proactive fraud identification through inventory verification, pattern analysis, and evidence quality assessment. AI-powered risk scoring and automated investigation routing for Special Investigation Units.

Yes, Xenonsure employs bank-level encryption, secure cloud storage, and blockchain-verified timestamps for all your inventory data. Your videos, images, and documents are protected with end-to-end encryption, and we never share your personal information with third parties.

By maintaining a complete, timestamped inventory of your possessions before any loss occurs, you can provide insurers with immediate proof of ownership and value. This eliminates weeks of documentation gathering and significantly speeds up claims processing from months to days.

No training required! Xenonsure is designed to be intuitive and easy to use. Simply walk through your home with your phone, record videos of your belongings, and our AI automatically catalogs everything. The entire process takes minutes, not hours.

Yes! You can create separate inventories for multiple properties including vacation homes, rental properties, or storage units. Share access with family members so everyone can view and contribute to the inventory. Perfect for estate planning and family coordination.

Xenonsure's pre-loss video inventories with blockchain timestamps eliminate the majority of fraudulent claims. Insurers can verify that claimed items actually existed before the loss, dramatically reducing false claims, inflated valuations, and staged losses that cost the industry billions annually.

Absolutely. Our B2B SaaS platform integrates seamlessly with existing policy administration systems, claims management platforms, and underwriting workflows through standard APIs.

Insurers typically see 40-60% reduction in claims processing time, 70-80% decrease in fraudulent claims, and 30-50% improvement in customer satisfaction scores. The average ROI is achieved within 6-9 months through operational savings and reduced fraud losses.

Our AI Assistant maintains continuously updated regulatory databases covering federal, state, and local requirements. It provides real-time compliance guidance, automates policy language generation with jurisdiction-specific requirements, and alerts teams when regulatory changes impact existing policies or underwriting guidelines.

Join world-class homeowners using Xenonsure to protect their most valuable possessions in record time.

Watch demo